Regardless of what people say – housing is emotional. Most people are overly optimistic about not only their neighborhood but the value of their house.

Yes, a house is an investment – because it’s a huge financial obligation and liability if you took out a mortgage.

However, it’s easy to get attached to this investment emotionally because we live there – we don’t just log-in to a website and check the value.

It’s important to note that if you sell your house because you think we are in a bubble and buy in the next bust (which I presume is around 2018 or 2019) you could still potentially lose money because of the heavy transactional cost with real estate.

It’s also important to note that you can very rarely rent for a lower amount than a typical mortgage. Home ownership also has a significant amount of tax advantages as well.

Let’s look at some data to figure out if we are in another housing bubble.

You can see in the chart below that we are above the long-term trend in home prices. However, if the trend is 3.2% you are effectively mitigating inflation with a 3.5% mortgage after taxes!

A great lengthy economic presentation from my favorite economist. The most important parts here is the data he gathered about home ownership and the rental market.

David Rosenberg Slides by zerohedge

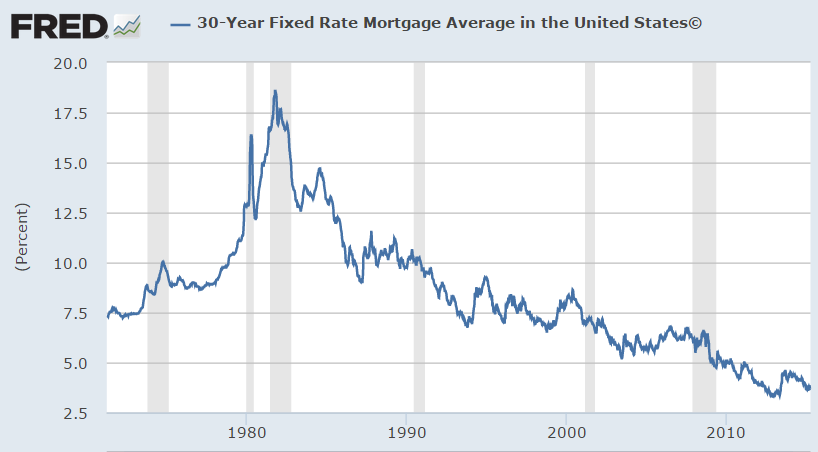

This is a great long-term chart from the Federal Reserve. Just remember the next time someone tells you rates can’t go lower – they have 0.5% mortgage rates in Japan!!!!!

The chart below is my favorite of all the data sets. I’m surprised nobody else is talking about this. Home sales are forecasted to decline dramatically in 2018!

Summary

You can see with the above data that low interest rates have driven home sales back to extraordinary levels. What is fascinating is the fact that home ownership with millennials keeps declining.

I am not an economic prognosticator but the data shows that home sales will fall off a cliff with any material increase in interest rates.

Let me know on Linked-In or Facebook what you think – Are we in another real estate bubble?